Compliances We Serve

PAN (Permanent Account Number)

Purpose: PAN is used for tracking financial transactions and identifying taxpayers.

Format: It’s a 10-character alphanumeric number (e.g., ABCDE1234F).

Who Needs It: Individuals, companies, HUFs (Hindu Undivided Families), partnerships, and other legal entities.

Uses:

Filing income tax returns.

Making investments (like opening bank accounts, buying property).

Conducting high-value financial transactions

TAN (Tax Deduction and Collection Account Number)

Purpose: TAN is required by entities that need to deduct or collect tax at the source (TDS/TCS).

Format: It’s also a 10-character alphanumeric number, but the format differs slightly from PAN (e.g., ABCD12345E).

Who Needs It: Businesses, organizations, or individuals who are responsible for deducting or collecting taxes.

Uses:

Deducting TDS for employees or contractors.

Collecting TCS.

Submitting TDS/TCS returns.

Employee State Insurance (ESI)

Employee State Insurance (ESI) is a social security and health insurance scheme for workers in India, managed by the Employee State Insurance Corporation (ESIC), which operates under the Ministry of Labour and Employment, Government of India. This scheme provides medical and financial benefits to employees and their families during times of illness, injury, maternity, and other emergencies.

Key Aspects of ESI

Employee State Insurance (ESI) is a social security and health insurance scheme for workers in India, managed by the Employee State Insurance Corporation (ESIC), which operates under the Ministry of Labour and Employment, Government of India. This scheme provides medical and financial benefits to employees and their families during times of illness, injury, maternity, and other emergencies.

Eligibility:

- Applicable to employees earning a monthly wage of up to ₹21,000 (₹25,000 for employees with disabilities).

- All factories and establishments with 10 or more employees (or 20 in certain states) are required to register for ESI

- Employer’s Contribution: 3.25% of the employee’s monthly wages.

- Employee’s Contribution: 0.75% of the employee’s monthly wages.

- Contribution rates may be subject to change by ESIC.

- Medical Benefits: Comprehensive medical treatment for the insured person and family members at ESIC hospitals and dispensaries.

- Sickness Benefits: Paid leave with up to 70% of wages for up to 91 days in a year in case of illness certified by an ESIC doctor.

- Maternity Benefits: Maternity leave with full wages for up to 26 weeks, or 6 weeks in case of miscarriage.

- Disablement Benefits: Temporary Disablement: Financial compensation at 90% of wages until recovery.Permanent Disablement: Compensation at a rate depending on the extent of disability.

- Dependents’ Benefit: Monthly pension to dependents in case of death due to work-related injuries.

- Funeral Expenses: A lump sum of ₹15,000 is provided to cover funeral expenses.

- Registration can be done online through the ESIC portal.

- After registration, the employee receives an ESI card, which they can use to avail of benefits at ESI hospitals and dispensaries.

ESI Code Number:

- Employers are issued an ESI code, a unique 17-digit number for all interactions with ESIC.

The Employee Provident Fund (EPF)

The Employee Provident Fund (EPF) is a social security scheme in India, aimed at providing financial security and stability to employees after retirement. Managed by the Employees’ Provident Fund Organisation (EPFO), the EPF is a compulsory savings scheme for employees and their employers, who contribute a portion of wages to build a corpus.

Key Aspects of EPF

The Employee Provident Fund (EPF) is a social security scheme in India, aimed at providing financial security and stability to employees after retirement. Managed by the Employees’ Provident Fund Organisation (EPFO), the EPF is a compulsory savings scheme for employees and their employers, who contribute a portion of wages to build a corpus.

Eligibility:

- Applicable to employees working in establishments with 20 or more employees.

- Employees with a basic salary (including dearness allowance) of up to ₹15,000 per month must contribute to the EPF.

- Employees earning above ₹15,000 can also opt for EPF voluntarily.

Contribution Rates:

- Employee’s Contribution: 12% of basic salary + dearness allowance.

- Employer’s Contribution: 12%, out of which:

- 3.67% goes to the EPF account.

- 8.33% goes to the Employee Pension Scheme (EPS).

- Total Contribution: 24% of basic salary + dearness allowance (split between employee and employer).

- For smaller establishments with fewer than 20 employees, the contribution rate may be 10%.

Interest on EPF:

- EPFO annually declares an interest rate for the EPF, which is credited to the employees’ EPF accounts.

- The interest earned is tax-free up to a specific threshold for contributions (as per tax regulations).

Benefits of EPF:

- Retirement Corpus: The EPF accumulates over time, providing a retirement corpus for employees.

- Pension Benefits: Contributions also go towards the EPS, giving employees a pension upon retirement if they meet the minimum service requirement of 10 years.

- Partial Withdrawals: Employees can partially withdraw funds in specific cases like medical emergencies, education, marriage, or purchasing/construction of a house.

- Insurance Benefits: Employees are covered under the Employee Deposit Linked Insurance Scheme (EDLI), providing life insurance benefits to employees.

Tax Benefits:

- Contributions to EPF are tax-deductible under Section 80C of the Income Tax Act.

- Interest earned and the amount withdrawn (after a continuous service of 5 years) are also tax-free.

UAN (Universal Account Number):

- Every EPF member receives a Universal Account Number (UAN), a unique identifier that links all EPF accounts across jobs.

- Employees can manage their EPF account, check their balance, and access other services online using their UAN on the EPFO portal.

Withdrawals and Transfer of EPF:

- EPF can be withdrawn fully on retirement or after being unemployed for more than two months.

- Partial withdrawals are allowed for specific purposes.

- UAN facilitates seamless transfer of EPF balances when employees change jobs.

- The EPFO provides online services, including e-nomination, balance check, passbook view, claim filing, and grievance resolution through its portal and mobile app.

The EPF scheme encourages savings and provides a secure retirement income, making it an essential component of social security for Indian employees.

- ESI PF₹ 10000

The Importer Exporter Code (IEC)

The Importer Exporter Code (IEC) is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry in India. The IEC is mandatory for businesses or individuals involved in importing or exporting goods and services from India. It serves as an identification for international trade transactions.

Key Aspects of IEC

Benefits of IEC:

- Global Market Access: Enables businesses to expand into international markets.

- Government Schemes and Incentives: Required for businesses to access various export-related incentives and schemes offered by the Government of India, like the Merchandise Export from India Scheme (MEIS) and Service Export from India Scheme (SEIS).

- Export Earnings: Helps Indian businesses earn in foreign currency, improving their cash flow and strengthening the overall economy.

- Not required for personal imports/exports (non-commercial purposes).

- Specific government departments and ministries are also exempt.

The IEC serves as a primary identification for importers and exporters in India and simplifies the process of conducting business with international markets.

- IE Code₹ 3500

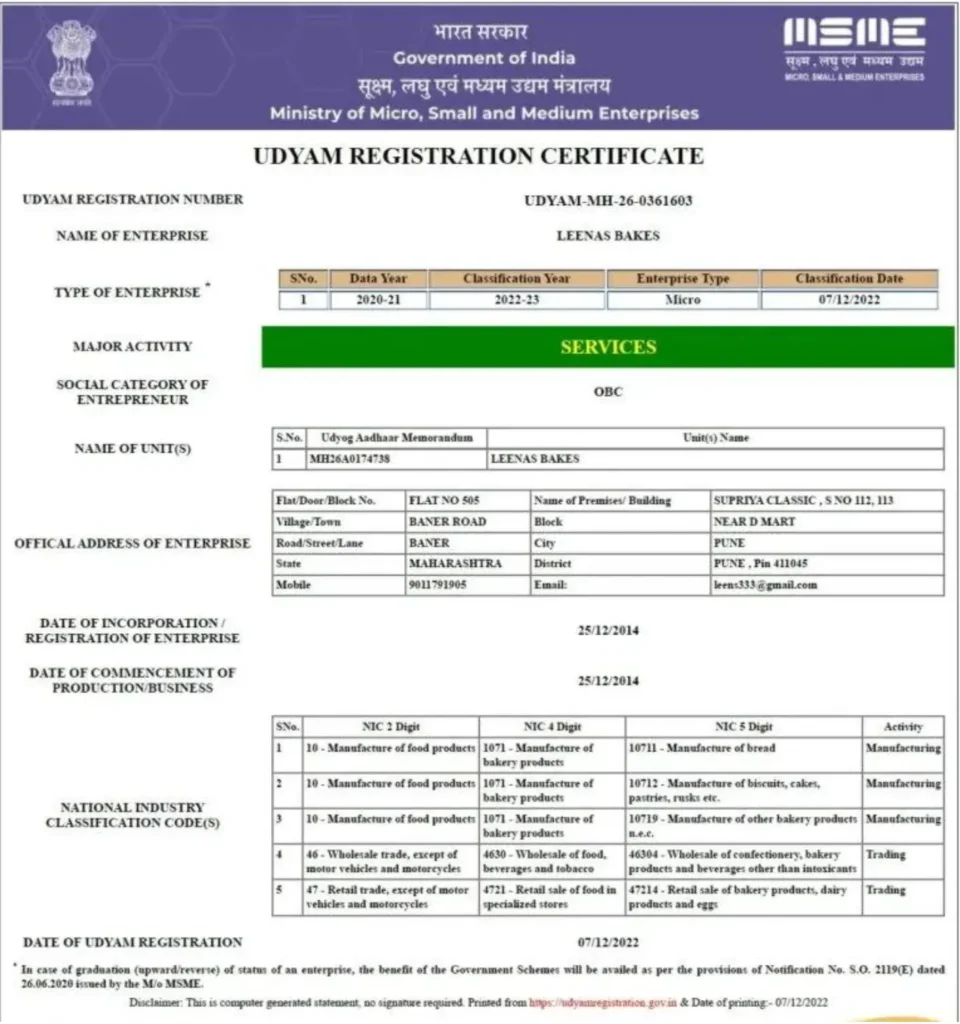

MSME (Micro, Small, and Medium Enterprises)

MSME (Micro, Small, and Medium Enterprises) registration in India is a government initiative to promote and support small businesses. Registered MSMEs gain access to various benefits, such as government subsidies, financial assistance, and tax exemptions. The Ministry of Micro, Small and Medium Enterprises manages this process, and it’s fully online.

Categories of MSMEs

MSMEs are classified based on their investment in plant and machinery or equipment and annual turnover:

Micro Enterprise:

- Investment: Up to ₹1 crore.

- Turnover: Up to ₹5 crore.

Small Enterprise:

- Investment: Up to ₹10 crore.

- Turnover: Up to ₹50 crore

Medium Enterprise:

- Investment: Up to ₹50 crore.

- Turnover: Up to ₹250 crore.

Benefits of MSME Registration

- Access to Loans: MSMEs can obtain collateral-free loans under government schemes like the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE).

- Interest Rate Subsidies: Eligible for lower interest rates on loans.

- Government Subsidies: Eligible for subsidies on technology, machinery, and registration of patents.

- Tax Exemptions: Certain tax exemptions are provided to MSMEs.

- ISO Certification Cost Reimbursement: MSMEs can get reimbursed for ISO certification expenses.

- Priority Sector Lending: MSMEs receive priority lending from banks and financial institutions.

- Protection Against Delayed Payments: MSMEs have legal protection under the MSME Act, which mandates prompt payment from buyers and penalizes delayed payments.

MSME Registration Process (Udyam Registration)

- Visit the Udyam Registration Portal: Registration is done through the government’s official Udyam Registration portal.

- Aadhaar Requirement:

For Individual/Proprietorship: The business owner’s Aadhaar is required.

For Partnership Firms, LLP, Companies: The Aadhaar of the partner or director is used. - Fill Out Basic Information:

Business name and type (proprietorship, partnership, LLP, company, etc.).

PAN number and GSTIN (if applicable).

Details of the owner (Aadhaar, PAN).

Details of the business (type, address, and bank account). - Provide Investment and Turnover Information: Details of investment in plant and machinery/equipment and turnover as per the limits of MSME classification.

- Submit the Application: After entering all details, submit the form online.

- Issuance of Udyam Registration Certificate: Once verified, an MSME certificate is issued. It contains a unique Udyam Registration Number (URN) that serves as proof of MSME status.

- Important Points

Single Registration: A business can only register once, regardless of the number of activities or branches. - No Renewal: MSME/Udyam registration does not require renewal and remains valid for the business’s lifetime.

- Updating Details: Businesses must update their turnover and investment data as necessary.

- Exemptions and Non-Eligibility

Non-eligible Businesses: Large businesses or enterprises that do not meet the MSME classification limits cannot apply for MSME registration. - Voluntary Registration: Registration is not mandatory, but it is beneficial for availing of government schemes and incentives.

MSME registration helps businesses receive benefits and support from the government, improving their sustainability, financial health, and growth potential in India.

- MSME Registration₹ 2000

The Food Safety and Standards Authority of India (FSSAI)

The Food Safety and Standards Authority of India (FSSAI) issues food licenses in India to regulate and ensure the safety and quality of food products. Any food business, whether manufacturing, processing, packaging, distributing, or retailing food items, must obtain an FSSAI license to legally operate in the country.

Types of FSSAI Food Licenses

There are three types of FSSAI licenses based on the scale and nature of the food business:

- Basic FSSAI Registration:

For: Small food businesses or startups with an annual turnover of up to ₹12 lakhs.

Eligibility: Small retailers, petty food manufacturers, hawkers, food stalls, or small-scale businesses.

Application Form: Form A. - State FSSAI License:

For: Medium-sized food businesses with an annual turnover between ₹12 lakhs and ₹20 crores.

Eligibility: Small to medium-sized manufacturers, storage units, transporters, marketers, and distributors.

Application Form: Form B. - Central FSSAI License:

For: Large food businesses or companies with a turnover above ₹20 crores, or businesses involved in import/export.

Eligibility: Large manufacturers, food import/export units, central government agencies, and restaurants with multi-state operations.

Application Form: Form B.

Documents Required for FSSAI Registration

Basic FSSAI Registration:

- Proof of address (e.g., utility bills or rental agreement).

- Photograph of the applicant.

- FSSAI declaration form.

State and Central FSSAI Licenses:

- Proof of address.

- Identity and address proof of the applicant.

- Layout plan of the manufacturing unit.

- Food safety management plan.

- NOC from local authorities (if required).

- List of food products to be handled/manufactured.

- For central licenses, import/export code (if applicable) and supporting documents for any government-owned businesses

Application Process for FSSAI License

Create an Account on the FSSAI Portal:

- Register on the FSSAI’s online portal.

- Choose the appropriate type of license (Basic, State, or Central) based on turnover and scale.

Fill the Application:

- Fill out Form A for Basic registration or Form B for State or Central licenses.

- Upload all necessary documents as per the license type.

Pay Fees:

- Pay the applicable fees, which vary based on the license type and duration (1 to 5 years).

Inspection and Approval:

- For State and Central licenses, an FSSAI officer may inspect the premises for compliance with food safety standards.

- Upon successful verification and inspection, the FSSAI license is issued.

Issuance of License:

Once approved, an FSSAI license number is issued. This number must be displayed on food packages, menus, and any relevant business documents.

Renewal of FSSAI License

- Validity: FSSAI licenses are valid for 1 to 5 years, depending on the duration chosen at the time of registration.

- Renewal Application: The renewal process must begin at least 30 days before the expiration date to avoid late fees or penalties

Benefits of FSSAI Registration

- Consumer Confidence: Ensures customers about the safety and quality of food products.

- Legal Compliance: Required to operate a food business legally, avoiding fines and penalties.

- Brand Image: Improves credibility and builds trust with consumers.

- Expansion: Facilitates expansion opportunities and partnerships with other food-related businesses.

Penalties for Non-Compliance

- Operating without FSSAI License: Heavy fines, penalties, and even closure of the business.

- Misleading Claims: False claims or misrepresentation of food products can also attract penalties.

FSSAI licensing is mandatory for every food business in India, promoting a safe and transparent food industry that aligns with global food safety standards.

- Food Licenses Basic₹ 2000

- Central Food License₹ 13500

- State Food License₹ 7500

The Shop and Establishment Act

The Shop and Establishment Act in India is a state-specific law that regulates conditions of work and employment in shops, commercial establishments, and other specified businesses within each state or union territory. It ensures fair treatment of employees and sets out rules regarding working hours, holidays, wages, and other employment terms to safeguard the rights of workers and provide a formal structure for businesses.

Key Aspects of Shop and Establishment Act

Scope and Applicability:

- Applies to shops (retail outlets, service providers, etc.) and commercial establishments (offices, hotels, restaurants, theatres, amusement parks, etc.).

- The Act also covers certain businesses, residential hotels, eating houses, restaurants, and small commercial establishments.

- Each state has its own version of the Act with specific rules and regulations.

Objectives:

- To regulate work conditions, such as working hours, rest intervals, overtime, leaves, and holidays.

- To ensure minimum wages and a safe working environment.

- To provide guidelines on termination and grievance handling.

Registration under the Act:

- All businesses covered by the Act are required to register with the local government authority or the Labour Department.

- Registration Process: Submit an application form along with necessary documents like identity proof, proof of business address, and other relevant information.

- Registration Certificate: Upon verification, a registration certificate is issued, which must be displayed at the place of business.

Working Hours and Overtime:

- The Act specifies maximum working hours per day (typically 8–9 hours) and per week (usually 48 hours).

- Rest Intervals: A break after a specific number of working hours.

- Overtime Pay: For any work beyond standard hours, employees are entitled to overtime pay at a specified rate (typically double the regular rate).

Holidays and Leave:

- Weekly Holidays: Employees are generally entitled to one day off per week.

- Paid Leave: The Act mandates a certain number of paid leaves (varies by state) such as casual leave, sick leave, and privilege leave.

- Festival and National Holidays: Some states require businesses to provide paid time off on national and regional holidays.

Wages and Employment Terms:

- Minimum Wages: Ensures minimum wages as per state regulations.

- Notice Period and Termination: Specifies rules around notice periods, dismissal, and severance pay to ensure fair treatment.

Employee Welfare Provisions:

- The Act promotes a healthy work environment, with provisions for cleanliness, ventilation, lighting, restrooms, and safety measures.

- Establishments may also have to provide facilities for drinking water, first aid, and rest areas, depending on the nature of the business and state regulations.

Record Maintenance:

- Employers are required to maintain records, including attendance registers, salary records, overtime records, and leave details.

- These records must be produced to authorities upon request during inspections or audits.

Compliance and Penalties:

- Non-compliance can result in penalties, fines, or legal action.

- Inspections may be conducted by authorities to ensure adherence to the Act.

How to Register under the Shop and Establishment Act

- Submit Application: Online or offline application to the Labour Department or designated authority.

- Provide Documents: Identity proof, address proof, PAN, and details of employees (if required).

- Inspection and Verification: In some cases, authorities may inspect the premises.

- Receive Certificate: A registration certificate is issued, which must be renewed as per state-specific requirements.

Benefits of the Shop and Establishment Act Registration

- Legal Recognition: Provides legal recognition to businesses and enables them to operate smoothly.

- Bank Account: Helps in opening a current bank account in the name of the establishment.

- Labor Law Compliance: Ensures that businesses meet state labor laws, avoiding legal complications and penalties.

- Employee Rights Protection: Protects employees’ rights, fostering a positive work environment and employee satisfaction.

The Shop and Establishment Act establishes a standardized framework for fair labor practices, benefiting both employers and employees and contributing to the formal economy.

Have any Questions? Call us Today!

8072 431 237